The Indian Banks Association (IBA) has agreed to a 15% increase in salary of 8.5 lakh public sector bank employees, as part of the 11th bipartite settlement (BPS). Performance linked incentives (PLI) are also being introduced for the first time in govt banks in this agreement.

The 11th bipartite wage settlement was due from November 2017 but negotiations were happening in several rounds.There were numerous nation-wide strikes called upon by banking unions to expedite the decision.

On July 22, 2020 a MOU was signed between IBA and bank unions finalizing the 11th bipartite settlement putting an end to the long pending wage settlement issues. The minutes of the meeting with the list of items that were reached mutual consensus was later released to the public.

15% Salary Hike Approved

The negotiations between bank unions and the Indian Banks’ Association (IBA) concluded with both sides agreeing to an annual wage increase and allowances of 15%.

The wage revision will be effective from November 1, 2017 and shall be in force till 2022.

Pension: There will also be an increase the banks’ contribution to the NPS (New Pension Scheme) fund – from the existing 10 per cent to 14 percent of pay and dearness allowance, subject to the approval of the government.

Leave Encashment: From calendar 2020, besides encashment of privilege leave (PL) at the time of retirement and during availing of leave fare concession, PL encashment would be permitted at five days every calendar year (seven days in case of employees aged 55 and above) at the time of any festival of their choice.

Performance Incentives Introduced

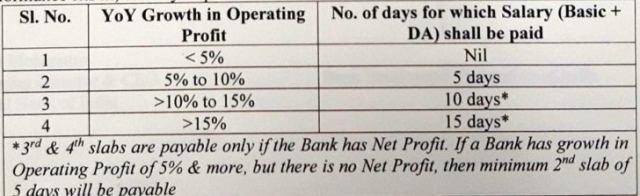

In a first for govt owned banks, a performance-linked incentive (PLI) scheme for public sector bank employees has also been agreed upon.

The PLI is payable to all employees annually over and above the normal salary payable and will be calculated on the basis of net profit of individual bank and is optional for private and foreign lenders.

As per the incentive matrix, if a bank posts 15% growth in operating profit, then an employee can earn as high as 15 days of pay as PLI.

“In order to inculcate a sense of competition and also a reward of performance, the concepts of performance-linked pay is felt to be introduced,” the agreement said.

No 5 Day Banking?

One of the most important demand of bank employee unions in the 11th bipartite settlement was 5 day banking. It would mean all employees work from Monday to Friday and get all Saturday and Sunday as holidays.

At present, banks have holidays only on the 2nd and 4th Saturdays every month and on every Sunday.

Bank unions have been demanding this proposal for more a decade and has featured continuously in various negotiations.But in the 11th BPS minutes, released few days ago, there is no mention of the 5 day work week demand.

So its a clear indication that the 5 day work week demand by bank unions is not approved. The Indian Banks’ Association (IBA) in January 2020, had rejected the unions’ proposal for a five-day working week calling it ‘unacceptable’.

A detailed joint note on the 11th bipartite settlement will be drawn and finalized within the next 90 days.It will give more clarity on the points that were reached consensus mutually.